It's easy to stay optimistic and hope that decision-makers act according to your wishes. Why does this occur? And why can it be a trap for investors?

The market sell-off, triggered by the U.S. imposing draconian tariffs on virtually all its trading partners, has temporarily paused. This happened due to a misinterpretation of a comment made by a White House official during a TV interview. When asked whether President Trump could pause the trade war for 90 days, the official responded that such decisions are up to the president.

Market participants immediately latched onto this idea, which led to the closure of a large number of short positions across all markets and to a notable rebound in stock indices, commodity assets, and cryptocurrencies. The U.S. dollar received support in the Forex market, partially allowing the ICE dollar index to recover and hold above the 103.00 mark.

So why did investors latch onto those seemingly insignificant words?

In my opinion, there are two main factors at play. The first is the logical hope that the current administration will avoid damaging the national economy. If we were to fall into a recession, it could negatively impact Trump's presidency as well. He aspires to be remembered in U.S. history as the "great savior of the homeland."

The second is the reports circulating that many countries are interested in negotiating with the U.S. on tariffs and may already be willing to make broad concessions to the American president's racketeering policies.

These two expectations are primarily responsible for the recent pause in the sell-off. Many in the market believe this is a good time to buy risky assets—stocks, cryptocurrencies, and commodity contracts. Historically, this strategy has worked for decades. But will it work this time? That is the main question. Could we see a second wave of sell-offs after disappointment sets in?

Yes, that risk is indeed real. Since Trump took office, investors have navigated through a fog of uncertainty. On Monday, sentiment briefly improved following speculation that the president might consider a 90-day delay in new tariffs—but the White House quickly denied it. Then Trump threatened to impose an additional 50% tariff on imports from China starting Wednesday if Beijing doesn't withdraw its countermeasures.

In short, this rebound could be a "dead cat bounce" followed by a resumption of chaotic declines. And the trigger could be Trump's announcement of new tariffs on China as early as Wednesday. Could he do it? Absolutely. By now, everyone should be convinced that the 47th U.S. president doesn't back down. He might maneuver—but he doesn't concede.

What can we expect in the markets?

I believe the overall picture remains negative. Only real changes in Washington's trade policy toward the rest of the world could spark a strong rally in stock markets, which have dropped significantly and are now highly attractive. I think medium—and long-term investors are already picking up attractive stocks. As for tokens, interest will likely remain weak. Equities are now more appealing because, unlike cryptocurrencies, they offer not only lower prices but also dividends.

The U.S. dollar could stage a confident reversal upward against major currencies on the Forex market. Even minor progress in trade negotiations with partners could be seen as a positive shift in America's trade balance and a fundamental reason to strengthen the dollar and its global influence.

A potential resolution of the tariff stalemate would also likely support commodity assets. Oil and industrial metals may see a significant boost from increased demand, while gold could continue to decline.

However, the above scenario can only play out if trade tensions ease. Until that happens, the risks of a renewed sell-off remain, potentially becoming a trap for investors.

Daily Forecasts:

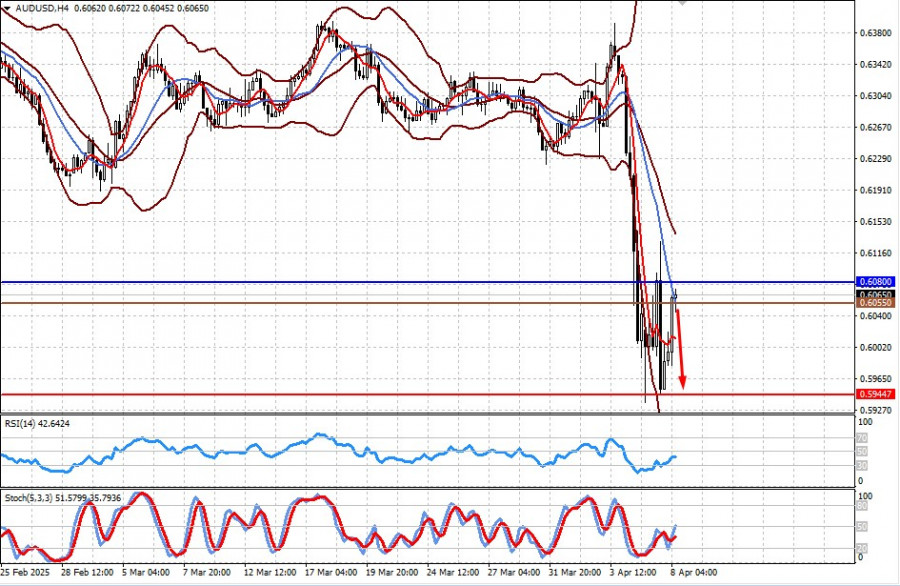

AUD/USD

The pair corrected upward on Monday's wave of optimism. If the situation fails to improve further, expect a renewed drop toward 0.5944, driven by Trump's risk of new tariffs on China. The entry point could be the 0.6055 level.

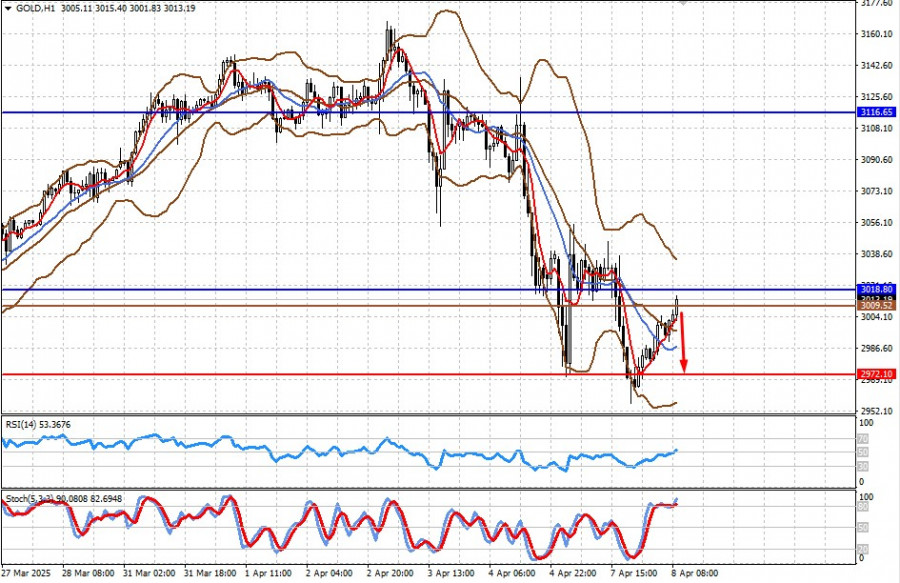

GOLD

Gold prices were supported by short-covering, but there's still a chance of further decline toward 2972.10 unless the price rises and holds above the 3018.80 level.