On Tuesday, US stock index futures were almost unchanged, as the market recovered a little after the recent spikes in volatility, which were directly related to concerns about the economy and a sharp increase in inflation. And if the first problem was solved, or rather postponed until December 2021, then the second one has turned a blind eye after the recent report on the American labor market, which disappointed traders a little while allowing the market to keep a certain balance. Also, the market's calmness is directly related to the launch of reports for the 3rd quarter of this year. It promises to be quite hot, and everyone is counting on good indicators, leading to the strong growth of sectors and major indices.

Dow Jones Industrial Average futures fell 15 points. S&P 500 futures showed no change, while Nasdaq 100 futures rose 0.2%. Growth was noted in the technology sector, which occurred due to companies such as Tesla, Alphabet, Netflix, and Nvidia.

The market suffered small losses yesterday: the Dow blue-chip index fell by 250 points, and the S&P 500 index fell by 0.7%. Immediately 9 out of 11 sectors closed in the red.

As noted above, the complete calm in the market is directly related to the beginning of companies' corporate earnings reports. Traders will look for any hints of negative changes in them, as the threat of a slowdown in growth in the fourth quarter looms quite high for many companies. The slowdown in global economic growth and high inflation, together with disruptions in the supply chain, is unlikely to maintain the previous pace. If companies' data on growth prospects quickly disappoint traders and investors, it would be wise to prepare for new shocks and market crashes in the short term.

JPMorgan Chase and other major banks will start the reporting season for the third quarter at the end of this week. According to economists' forecasts, profit is expected to grow by about 30% year-on-year this quarter after a 96.3% increase in the second. However, apart from the banking sector, expectations regarding the profits of the number of other companies for the third quarter have decreased in recent weeks, which should create some room for growth surprises, which is good for the overall market mood.

Now let's quickly run through the premarket and figure out the main movements and news of the companies:

Let's start with the health sector. GlaxoSmithKline - shares of the pharmaceutical manufacturer jumped 3.1% in the premarket after reports that the company's $54 billion consumer goods division conducted another successful round of raising funds from private investment companies. But things are not the best in CureVac. Premarket shares fell 15.5% after the company said it would stop developing its most advanced COVID-19 vaccine. The decision was made after the European Medicines Agency said it would not speed up the approval process for a vaccine approval application.

Well, you can't miss the company Moderna. Their securities have risen by 1% on the premarket ahead of the Food and Drug Administration commission meeting, which will be held on Thursday. It will consider the company's application for approval of booster vaccinations using its COVID-19 vaccine. The information documents are scheduled to be published today, which will shed light on the prospects for approval.

Airbnb securities gained 2.4% after their valuation was revised to "buy." The revision was related to the expected increase in bookings, which may increase significantly in 2022.

Nike rose 1.3% in the premarket after Goldman Sachs revised the rating to "buy," citing favorable conditions in the industry, as well as active growth initiatives by the manufacturer of sports shoes and clothing.

Well, in conclusion, Tesla shares rose 1.0% in the premarket after the news that in September, the company sold just over 56,000 cars produced in China, which is the largest monthly sales volume since production began in Shanghai two years ago.

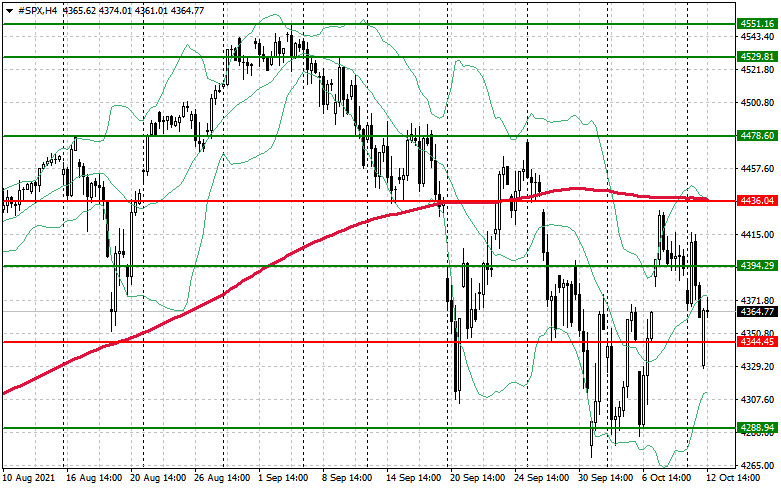

As for the technical picture of the S&P500 index

Nothing much has changed here. All the efforts of buyers to stay above $ 4,394 last week failed. It is quite possible that with the opening of the market, it will be possible to win back the observed gap quickly. In this case, buyers of the trading instrument can count on updating the highs around $ 4,436 and reaching the levels of $ 4,478 and $ 4,529. If the pressure on the index persists at the beginning of the week, and this option is not excluded before the start of the reporting season, the nearest support will be the area of $ 4,344, and a larger level is seen around $ 4,288.