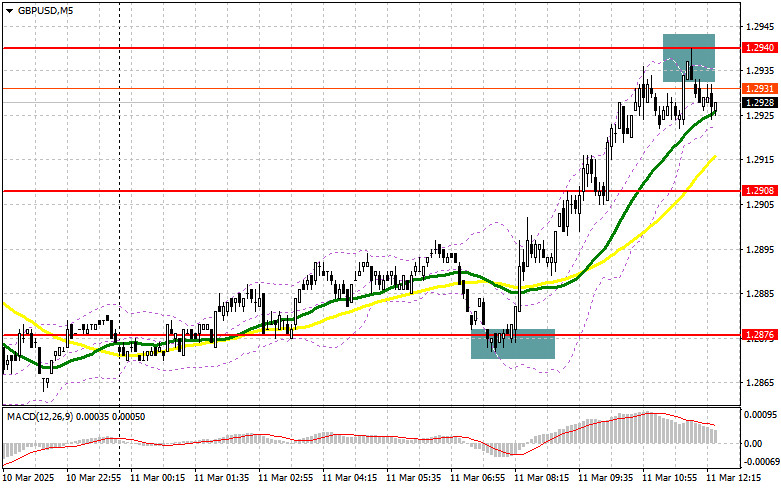

In my morning forecast, I focused on the 1.2876 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline and the formation of a false breakout around 1.2876 provided an entry point for buying the pound, which resulted in a 70-point increase in the pair. Sales on a false breakout from 1.2940 have so far shown about 15 points of profit. The technical picture has been revised for the second half of the day.

To open long positions on GBP/USD:

The absence of UK statistics and strong protection of the nearest support level at 1.2876 were enough to sustain the pound's bullish trend. In the second half of the day, US statistics are unlikely to disrupt the trend, as the data is not of major importance. The NFIB Small Business Optimism Index and the Job Openings and Labor Turnover Survey (JOLTS) from the Bureau of Labor Statistics are the only scheduled releases.

If GBP/USD declines as part of a correction, only a false breakout at 1.2908 will provide a good entry point for long positions, targeting a recovery to the 1.2940 resistance, where the pair is currently trading. A breakout and retest from top to bottom of this range will lead to another buying opportunity, with the potential for an increase to 1.2972, marking a return to the bullish market. The ultimate target will be 1.3006, where I plan to take profit.

If GBP/USD declines and buyers fail to show activity around 1.2908 in the second half of the day, selling pressure on the pound will increase, keeping the pair within a sideways channel. In this case, a false breakout around 1.2876 will be the only valid condition for opening long positions. I plan to buy GBP/USD on a direct rebound from 1.2841, targeting a 30-35 point intraday correction.

To open short positions on GBP/USD:

Sellers successfully prevented the pound from breaking through key resistance. In the second half of the day, the focus will be on defending the 1.2940 resistance level, as the pair continues to trade around this range despite a correction. A false breakout at 1.2940, along with strong US data, could provide an optimal selling point, aiming for a decline to 1.2908, the midpoint of the sideways channel.

A break and retest from below of this level will trigger stop-loss orders, opening the way to 1.2876. The final target will be 1.2841, where I plan to take profit. A test of this level may halt further bullish development.

If demand for the pound remains strong in the second half of the day and bears fail to defend 1.2940, I will postpone short positions until the 1.2972 resistance test. I will sell only on a false breakout at this level. If there is no downward movement, I will look for short positions on a rebound around 1.3006, aiming for a 30-35 point correction.

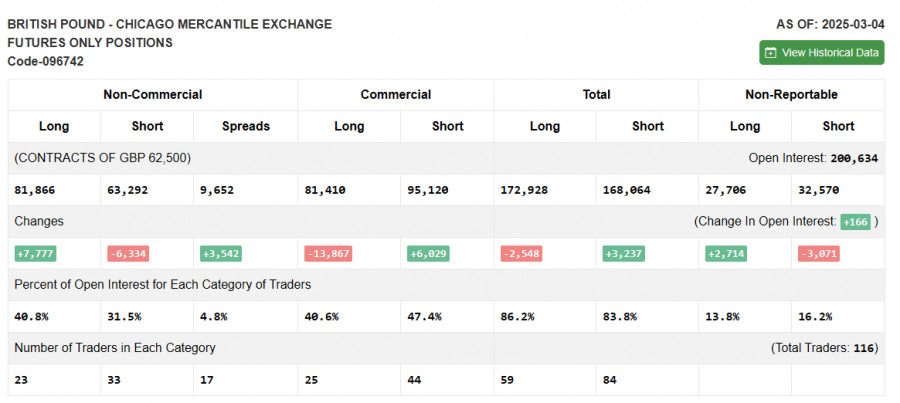

COT Report (Commitment of Traders) for March 4:

The latest COT report showed a modest increase in long positions and a decline in short positions. The growing dominance of buyers suggests a further rise in GBP/USD. Considering the positive trends in the UK economy and the gradual approach of the Bank of England to rate cuts, the pair is likely to continue its growth. However, market participants should be mindful of corrections that could emerge before new highs are reached.

The latest COT report showed that long non-commercial positions increased by 7,777, reaching 81,866, while short non-commercial positions decreased by 6,334, reaching 63,292. As a result, the net difference between long and short positions increased by 3,542.

Indicator Signals:

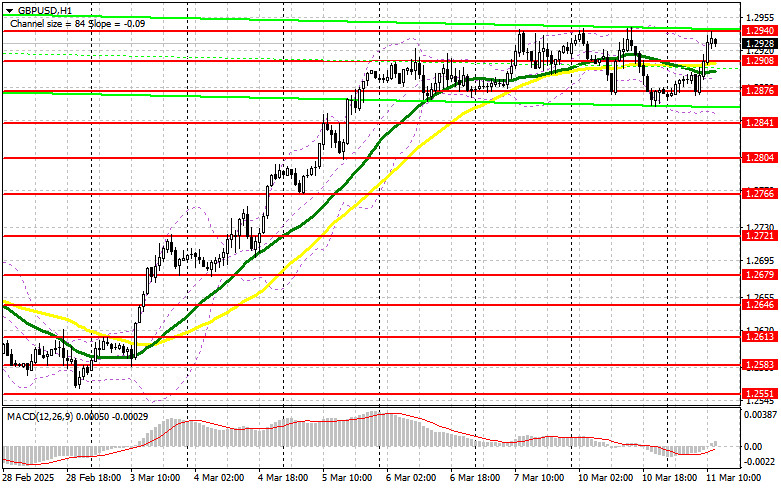

Moving Averages: The pair is trading above the 30- and 50-day moving averages, indicating further growth potential.

Note: The author analyzes moving averages based on the H1 chart, which may differ from the classical interpretation of daily moving averages (D1 chart).

Bollinger Bands: If the pair declines, the lower boundary of the indicator at 1.2855 will act as support.

Indicator Descriptions:

• Moving average (MA) – Identifies the current trend by smoothing out market volatility and noise. 50-period MA is marked in yellow on the chart. • Moving average (MA) – Another trend-following moving average with a 30-period, marked in green. • MACD (Moving Average Convergence/Divergence) – Fast EMA (12), Slow EMA (26), and 9-period SMA. • Bollinger Bands – A 20-period volatility indicator that helps identify overbought and oversold conditions. • Non-commercial traders – Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements. • Long non-commercial positions – The total number of long open positions held by non-commercial traders. • Short non-commercial positions – The total number of short open positions held by non-commercial traders. • Net non-commercial position – The difference between short and long positions among non-commercial traders.