The EUR/USD currency pair resumed its upward movement on Tuesday. The new week has just started, and there haven't been any significant macroeconomic data releases yet, yet the dollar is already declining. This is how long-term trends can change. The U.S. currency had been steadily increasing for 16 years, but now it seems that no one wants it anymore. All it took was Donald Trump assuming the presidency.

Sometimes, it feels like Trump either has a brilliant plan or a complete lack of understanding. His statements, even during his first term, were often astonishing. This isn't just about his constant insults, contradictory statements, or outright lies. It's also about the fact that the president of a country with the world's largest economy believes that another country should voluntarily become part of it. He thinks that trade relationships and friendly ties developed over decades can be dismantled in just a few months. But for what purpose? What benefits has America gained from Trump's actions? Or at the very least, what potential benefits could it gain in the future?

Right now, people worldwide are simply refusing to buy Tesla cars, and Elon Musk's company stock—Musk being one of Trump's closest allies—is plummeting. There's a boycott against Tesla, a boycott against American goods, protests against Donald Trump, significant deterioration in trade relations, worsening ties with neighboring and partner countries, a decline in the cryptocurrency market, a drop in the stock market, and looming recession risks for the U.S. economy. Was it all worth it?

Meanwhile, the euro and the pound continue to take advantage of the situation. They don't need to do anything or prove anything to rise almost daily. Previously, for the euro to strengthen, there had to be specific, positive macroeconomic reasons or fundamental justifications. Now? No. Trump continues to push his agenda; the market continues selling the dollar, American stocks, and even Bitcoin. The six-month trend, which seemed unshakable just a week and a half ago, now looks quite uncertain. Even the 16-year trend no longer seems so solid. And this is happening even though all macroeconomic and fundamental factors still favor the dollar.

Given the current circumstances, there is little value in analyzing the reasons behind the dollar's decline, as the factors are quite apparent. Since there is nothing currently influencing the currency pair's movement, the euro could potentially rise indefinitely. It remains uncertain when the market will stop reacting to Trump's actions. There are no technical reference points for the current price movement. Additionally, it is unclear what further actions the U.S. president might take, how many more trade wars he may initiate, or what his actual goals are. This ongoing movement presents a highly attractive opportunity for traders who rely solely on technical analysis.

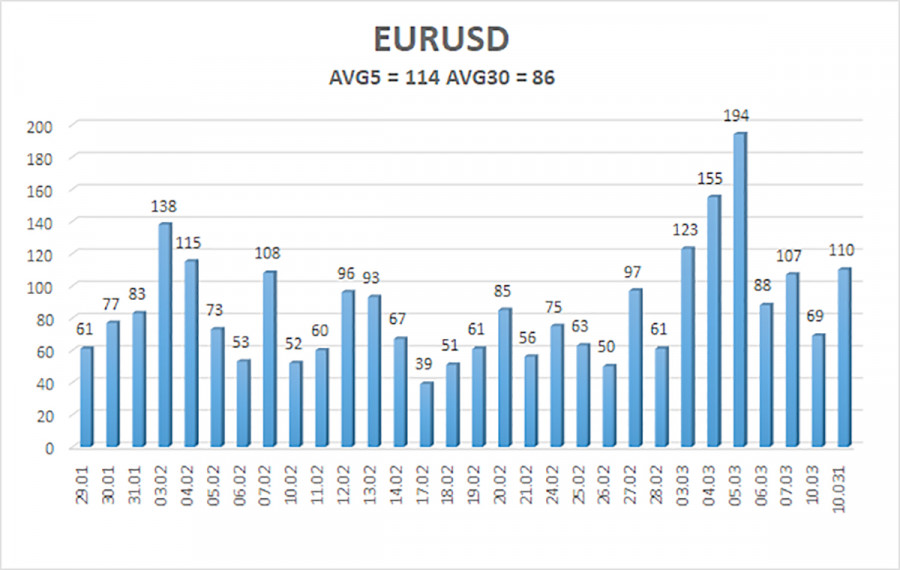

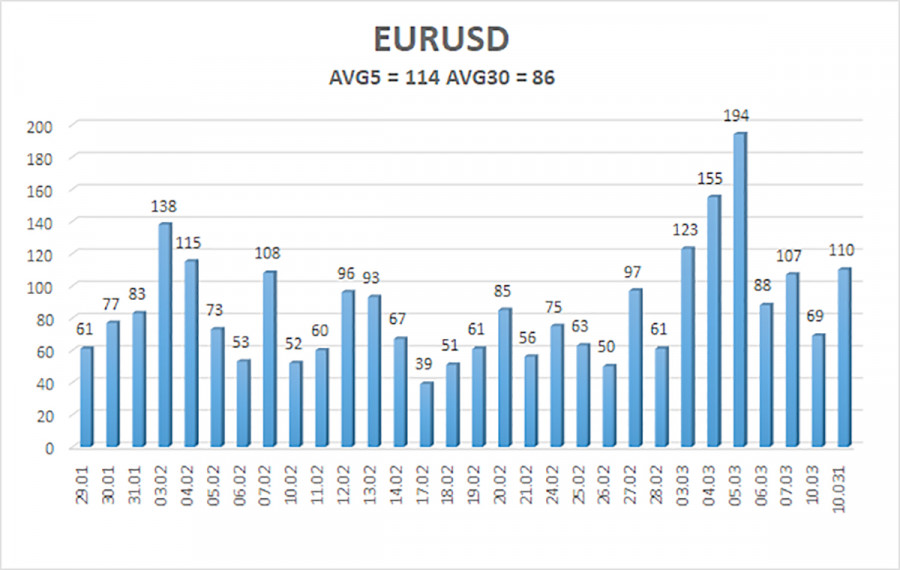

The average volatility of the EUR/USD currency pair over the last five trading days, as of March 12, is 114 pips and is considered "high." We expect the pair to move between the levels of 1.0816 and 1.1044 on Wednesday. The long-term regression channel has turned upward, but the global downtrend remains intact, as seen on higher time frames. The CCI indicator dipped into oversold territory again, signaling another wave of upward correction, which now barely looks like a correction at all...

Nearest Support Levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest Resistance Levels:

R1 – 1.0986

Trading Recommendations:

The EUR/USD pair has exited the sideways channel and continues its rapid growth. In recent months, we have repeatedly stated that we expect the euro to decline in the medium term, and at this moment, nothing has changed. The dollar still has no reason for a medium-term decline, except for Donald Trump. Short positions remain much more attractive, with targets at 1.0315 and 1.0254, but at this point, it is challenging to predict when the relentless growth will end. If you trade purely on technical analysis, long positions can be considered if the price remains above the moving average, with targets at 1.0986 and 1.1044.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.