The GBP/USD currency pair showed gains and losses throughout Wednesday. The afternoon decline once again raised some questions, though market movements in recent months have lacked much logic. The market remains in a state of panic. Typically, such a phase lasts a few days, but it could go on indefinitely in the current environment. In this article, we will indulge in speculation rather than conducting our usual analysis and forecasting.

What can we say if we briefly assess the early outcomes of the global trade war? As expected, all major players (the EU, China, Canada, Mexico, Japan, and others) did not cave into Trump's pressure and are planning to—or already have—implement retaliatory tariffs. Moreover, Brussels and Beijing maintain that it doesn't matter what tariffs Trump introduces; their response will be proportional.

Let's assume that Trump expected a completely different reaction. After all, he's not interested in "fair trade deals" with Lesotho and Zimbabwe but with China, the EU, and other wealthy nations. He likely assumed that representatives from these countries would rush to Washington to plead with the "king" for mercy. He says as much in every interview—claiming that China is desperate for a deal, though this desire seems nonexistent in China.

But in reality, things are not going according to Trump's plan. Both Europe and China have said they're open to negotiations, but they want fair trade based on international norms—not Trump's definition of fairness. And therein lies the core conflict: Trump's idea of fairness is entirely different.

What could happen next? China refuses to compromise. The EU might introduce 25% retaliatory tariffs starting April 16. No one wins from this, yet Trump would be compelled to respond with even more tariffs. How far is he willing to go? Imports from China have already doubled in cost for U.S. buyers. Will he wait until they quadruple? Or until the S&P 500 collapses by 50%?

And most importantly, what would Trump do if Beijing and Brussels never came crawling for a deal? Resort to military pressure? The EU is not Lesotho or Zimbabwe, after all. And China? That speaks for itself.

It feels like Trump is simply bluffing—constantly raising the stakes, trying to force partners to fold good hands and admit defeat. But these trade partners see through the bluff and are holding firm. Therefore, things may only get worse. However, Trump could also walk away from the trade war at any moment and claim victory regardless.

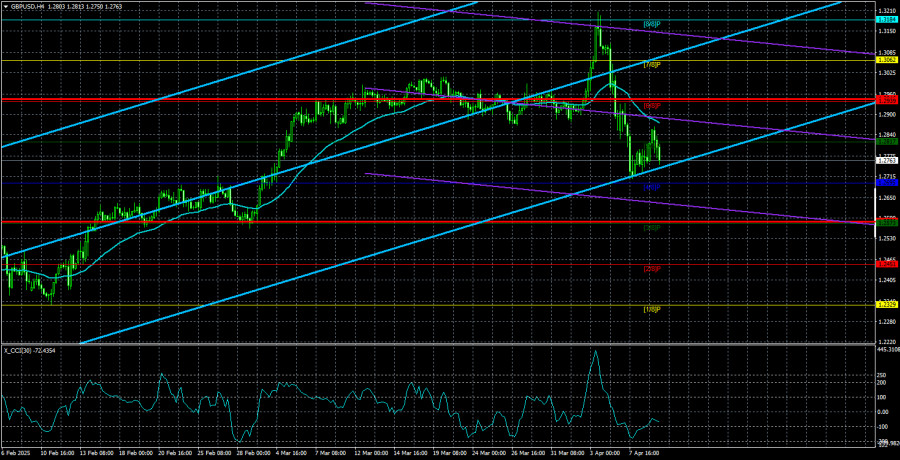

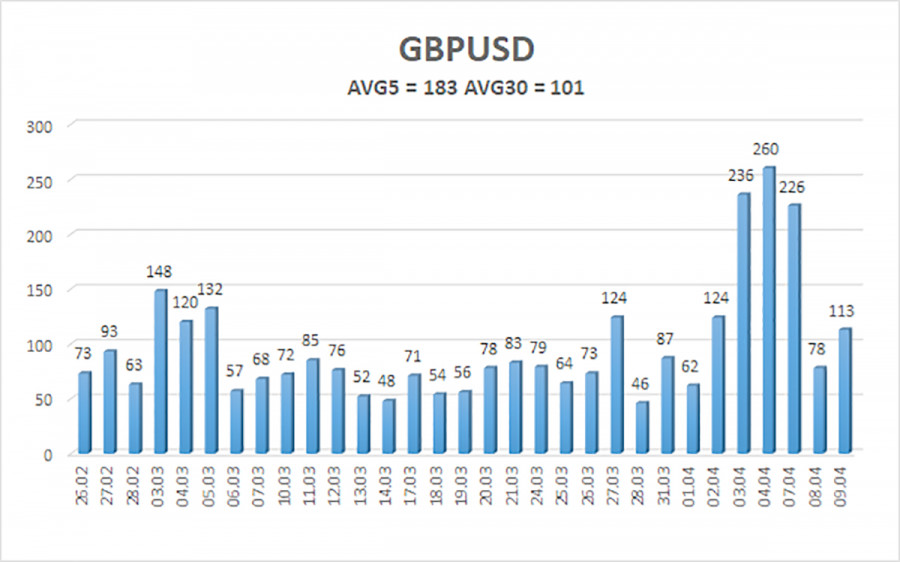

The average volatility for GBP/USD over the last five trading days is 183 pips, which is considered high for this pair. On Thursday, April 10, we expect the pair to trade within a range bounded by 1.2580 and 1.2946. The long-term regression channel is pointing upward, but a downtrend remains on the daily timeframe. The CCI indicator had entered overbought territory, signaling a downward pullback, which has now started to develop rapidly.

Nearest Support Levels:

S1 – 1.2695

S2 – 1.2573

S3 – 1.2451

Nearest Resistance Levels:

R1 – 1.2817

R2 – 1.2939

R3 – 1.3062

Trading Recommendations:

The GBP/USD pair has sharply declined, which could develop into a prolonged correction or even a new trend—something we've anticipated for months. We are still not considering long positions, as we believe the entire upward movement was just a correction on the daily timeframe that has now taken on a distorted, illogical shape.

However, if you trade based solely on technical analysis, longs may still be relevant with targets at 1.3062 and 1.3184, provided the price settles above the moving average again. The pound may resume growth if Trump continues to impose tariffs and other countries follow with their own.

Sell orders remain attractive with targets at 1.2207 and 1.2146 since the upward correction on the daily timeframe will eventually end—unless, of course, the previous downtrend ends first. Even if we're currently witnessing the beginning of a new uptrend, a solid downward correction is needed, as the British pound has risen too sharply in recent weeks.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.