The EUR/USD currency pair continued to trade calmly on Thursday, although volatility remained relatively high. This week, the US dollar showed some signs of recovery—something that could already be considered a success. Recall that since Donald Trump became President of the United States, the dollar has been under constant pressure. We've even previously suggested that the US dollar, stocks, and bonds decline is a kind of market protest against Trump's actions. And it must be said—it's not only traders and investors who are rebelling.

Yesterday, it was reported that attorneys general from 12 US states filed a joint lawsuit against Donald Trump, challenging the legality of the trade tariffs he imposed on half the world. Trump bypassed the need to push each of his decisions through Congress and the Senate by simply declaring a national emergency. As we can see, even in the super-democratic US, democracy can be easily sidestepped. Declare a state of emergency—and do whatever you want.

The lawsuit officially states that the US President undermined constitutional order and introduced chaos into the American economy by imposing unjustified import tariffs. Furthermore, the prosecutors accuse Trump of imposing tariffs and continuously altering and increasing them. In short, Trump is ruling the country single-handedly—and that doesn't sit well with many in America. We don't know how long a national emergency can be declared in the US, but it's a very effective tool. Declare a four-year emergency, and there's no need for Congressional approval—one could even dissolve the Democratic Party altogether.

Arizona Attorney General Kris Mayes stated that Trump's trade war is not only insane and absurd but also illegal. New York Attorney General Letitia James said Trump's tariffs would trigger economic decline, rising unemployment, and inflation. Of course, this has been known for a long time. Trump is likely expected to scare everyone into quickly signing trade deals favorable to the US—or, instead, to Trump personally. But that plan didn't work, and now it seems everyone is predicting a recession for the US economy, with the dollar plunging for two straight months.

Trump is slowly shifting his rhetoric, realizing the futility of his approach. Neither China, the EU, nor Canada came rushing to the White House to appease him. Now, we hear Trump talking about possibly lowering tariffs on China. Still, the dollar is practically unresponsive to such de-escalation hints, as there is no real sign of de-escalation at this point.

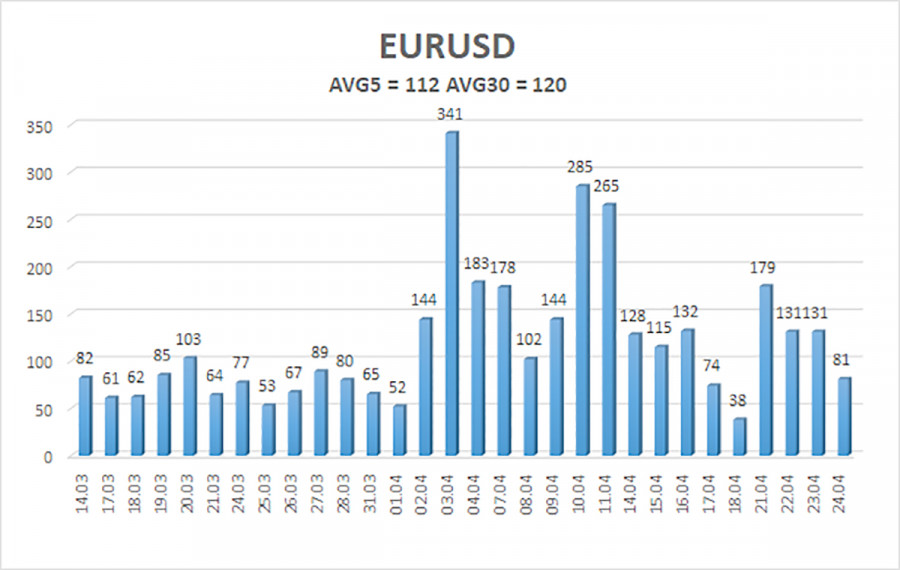

The average volatility of the EUR/USD pair over the last five trading days as of April 25 is 112 pips, which is classified as high. On Friday, we expect the pair to move within the range of 1.1244 to 1.1468. The long-term regression channel points upward, indicating a short-term bullish trend. The CCI indicator has entered the overbought zone for the third time, signaling the start of a new corrective move.

Nearest Support Levels:

S1: 1.1230

S2: 1.0986

S3: 1.0742

Nearest Resistance Levels:

R1: 1.1475

R2: 1.1719

R3: 1.1963

Trading Recommendations:

EUR/USD maintains a bullish trend. For several months, we've consistently stated that we expect a medium-term decline in the euro—and as of now, nothing has changed. The dollar still has no reason to fall—except for Donald Trump. Yet that alone continues to drive the dollar into the abyss, while the market ignores all other factors.

If you're trading purely on technicals or based on Trump's actions, long positions can be considered if the price remains above the moving average, targeting 1.1719.

If the price consolidates below the moving average, short positions with targets at 1.1230 and 1.0986 will formally become relevant—but believing in a dollar rally right now is extremely difficult, let alone expecting one.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.