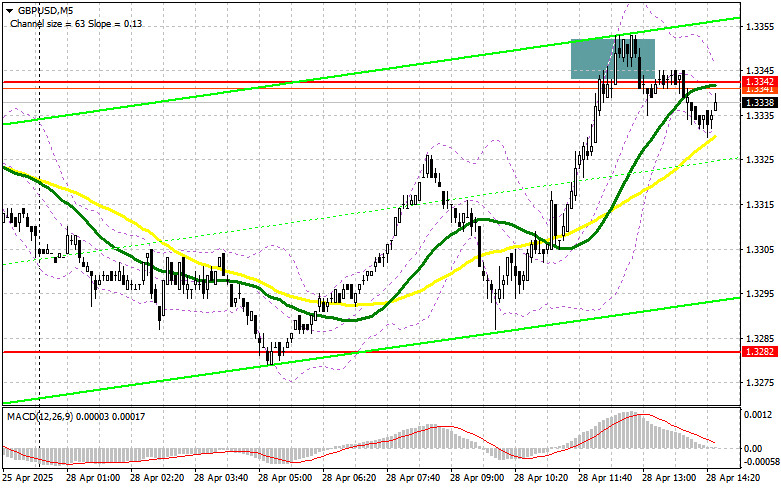

In my morning forecast, I focused on the 1.3342 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and see what happened. The pair rose and a false breakout around 1.3342 triggered a selling entry point for the pound, resulting in only a 10-point drop before the pressure eased. The technical picture was revised slightly for the second half of the day.

To open long positions on GBP/USD:

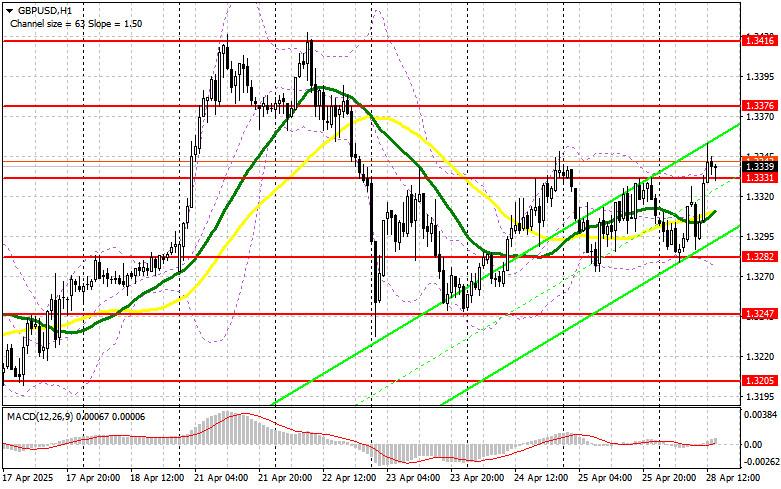

The rise in retail sales in the UK, according to data from the Confederation of British Industry, triggered some pound buying in the first half of the day, but it wasn't enough to resume a strong bullish market. Given that there is no important U.S. data in the second half of the day, pound buyers may try to maintain their advantage. However, under current conditions, it's better to act on buying from lower levels. Active buying and the formation of a false breakout around the new intermediate support at 1.3331, established during the first half of the day, would provide a good entry point for long positions aiming for a recovery toward the 1.3376 resistance. A breakout and downward retest of this range would create a new long entry point, targeting an update of 1.3416, allowing the bullish market to regain control. The ultimate target will be the 1.3462 level, where I plan to take profit.

If GBP/USD declines and bulls show no activity at 1.3331 in the second half of the day, pressure on the pair will return. In that case, only a false breakout around 1.3282 would offer a good opportunity to open long positions. Otherwise, I will consider buying GBP/USD on a rebound from the 1.3247 support area, targeting a 30–35 point intraday correction.

To open short positions on GBP/USD:

Sellers showed themselves in the first half of the day, but a significant decline didn't occur due to strong UK data. In case of another upward movement in the pound, I plan to act around the nearest resistance at 1.3376. A false breakout at this level would provide a selling entry point targeting a drop to 1.3331 support. A breakout and upward retest of this range would trigger stop-loss orders and open the way to 1.3282, slightly above where the moving averages are located, favoring the bulls. The ultimate target would be the 1.3247 level, where I plan to take profit.

If demand for the pound remains strong and bears show no resistance around 1.3376, it would be better to postpone selling until testing the 1.3416 resistance — the monthly high. I would only open short positions there after a failed consolidation. If there is no downward movement even there, I will look for short entries around 1.3462, but only for a 30–35 point intraday correction.

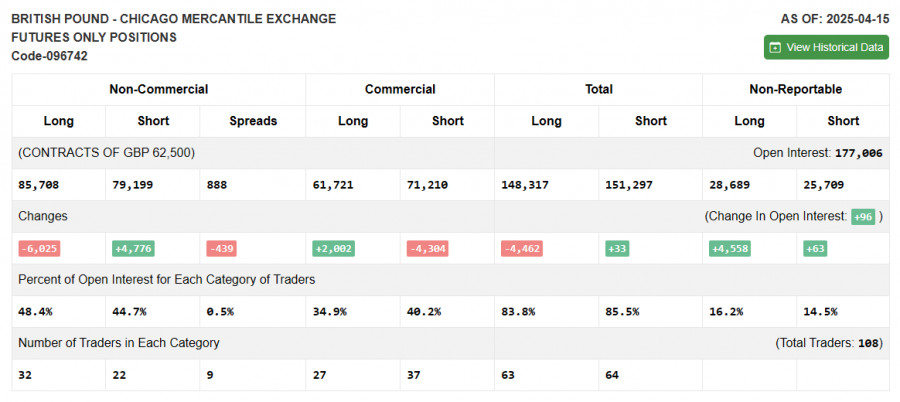

Commitments of Traders (COT) Report:

The COT report for April 15 showed an increase in short positions and a reduction in long positions. Interestingly, even with these figures, the pound has demonstrated fairly confident growth against the dollar. However, it's important to note that this data is delayed, and the recent major GBP/USD rally is directly tied to Donald Trump's tariff policy stance and dissatisfaction with Federal Reserve Chairman Jerome Powell — a factor putting more pressure on the dollar than supporting the pound. The latest COT report indicated that long non-commercial positions fell by 6,025 to 85,708, while short non-commercial positions rose by 4,776 to 79,199. As a result, the gap between long and short positions decreased by 439.

Indicator Signals:

Moving Averages:Trading is taking place above the 30- and 50-day moving averages, indicating an attempt by buyers to regain market control.Note: The periods and prices of moving averages are based on the author's analysis on the H1 hourly chart and differ from the classic definitions on the D1 daily chart.

Bollinger Bands:In case of a decline, the lower boundary of the indicator at around 1.3282 will act as support.

Indicator descriptions: • Moving average: identifies the current trend by smoothing out volatility and noise (50-period marked in yellow; 30-period in green). • MACD indicator (Moving Average Convergence/Divergence): fast EMA 12-period, slow EMA 26-period, SMA 9-period. • Bollinger Bands: period 20. • Non-commercial traders: speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain criteria. • Long non-commercial positions: the total number of open long positions by non-commercial traders. • Short non-commercial positions: the total number of open short positions by non-commercial traders. • Net non-commercial position: the difference between short and long positions among non-commercial traders.