signal strength 1 of 5

According to the chart of M5, AUDJPY formed the Bearish Symmetrical Triangle pattern. Description: The lower border is 92.02/92.38 and upper border is 92.67/92.38. The pattern width is measured on the chart at -65 pips. The formation of the Bearish Symmetrical Triangle pattern evidently signals a continuation of the downward trend. In other words, if the scenario comes true and AUDJPY breaches the lower border, the price could continue its move toward 92.23.

The M5 and M15 time frames may have more false entry points.

Veja também

- All

- Double Top

- Flag

- Head and Shoulders

- Pennant

- Rectangle

- Triangle

- Triple top

- All

- #AAPL

- #AMZN

- #Bitcoin

- #EBAY

- #FB

- #GOOG

- #INTC

- #KO

- #MA

- #MCD

- #MSFT

- #NTDOY

- #PEP

- #TSLA

- #TWTR

- AUDCAD

- AUDCHF

- AUDJPY

- AUDUSD

- EURCAD

- EURCHF

- EURGBP

- EURJPY

- EURNZD

- EURRUB

- EURUSD

- GBPAUD

- GBPCHF

- GBPJPY

- GBPUSD

- GOLD

- NZDCAD

- NZDCHF

- NZDJPY

- NZDUSD

- SILVER

- USDCAD

- USDCHF

- USDJPY

- USDRUB

- All

- M5

- M15

- M30

- H1

- D1

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

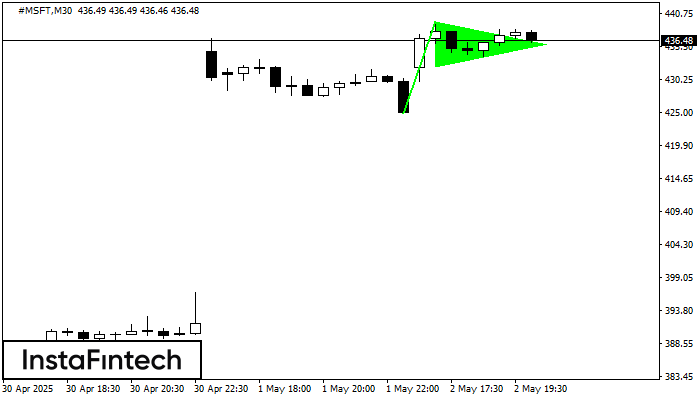

The Bullish pennant signal – Trading instrument #MSFT M30, continuation pattern. Forecast: it is possible to set up a buy position above the pattern’s high of 439.41, with the prospect

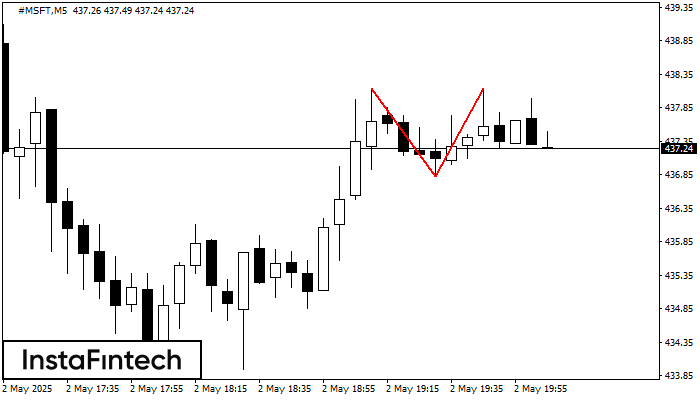

Open chart in a new windowThe Double Top pattern has been formed on #MSFT M5. It signals that the trend has been changed from upwards to downwards. Probably, if the base of the pattern 436.83

The M5 and M15 time frames may have more false entry points.

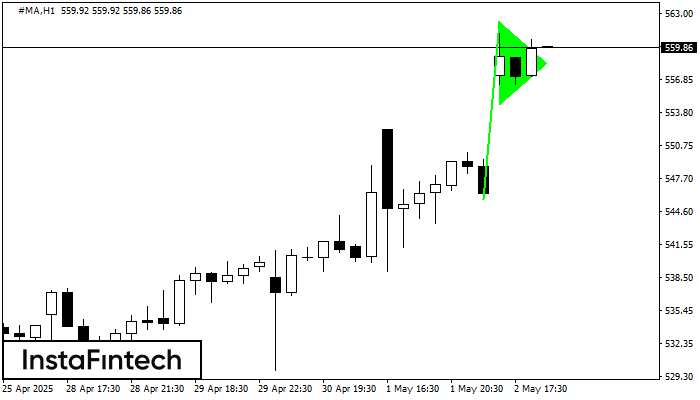

Open chart in a new windowThe Bullish pennant graphic pattern has formed on the #MA H1 instrument. This pattern type falls under the category of continuation patterns. In this case, if the quote can breaks

Open chart in a new window