Dollar bulls returned to active buying after a prolonged but not very deep correction. Currencies find it hard to resist the US dollar because of strong economic figures. However, this could not last forever. Let's consider the near-term prospects of the US currency.

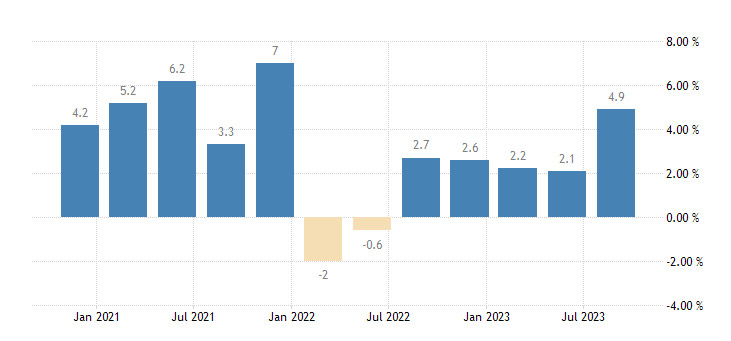

Betting against the dollar might seem futile, especially given recent data that unveiled the steady growth in the US economy. The latest report showed US GDP increased by 4.9% in the third quarter, notably exceeding forecasts of just 4.3%, compared to 2.1% in the previous quarter.

The third-quarter economic data not only surpassed expectations but also affirmed America's resilience despite its current financial policy. CIBC Capital Markets considers this growth to be remarkable, pointing out that the key driver was a jump in US consumer demand, which grew by 4% compared to just 0.8% in the second quarter.

Demand remains intact even in the face of recent interest rate changes, suggesting the economy might tolerate higher rates longer than anticipated. Predictions of sustained high rates over a long period strengthened the dollar, especially against the backdrop of Europe's slowing growth.

The report also highlighted a surge in the consumption of goods and services. Analysts believe this might be linked to improvements in the labor market. CIBC Capital Markets commented that investments in commercial real estate remained stable, while residential real estate investments grew by 3.9%, marking the first positive shift since the start of 2021. An increase in inventory levels also contributed to the overall 1.3% rise.

According to representatives from CIBC Capital Markets, the US economy will remain stable without further monetary policy adjustments.

Since the US dominance in the currency markets is obvious and greatly influences the dollar's value, it will be difficult to resist the dollar's strength, especially until significant economic shifts occur. The currency pairs EUR/USD and GBP/USD are likely to continue their downward trend. Currently, the pound/dollar pair stands at 1.2117, while the euro/dollar pair is at 1.0550.

Outlook for EUR and GBP

The long-term forecast for the EUR/USD pair is still based on factors like trade conditions, interest rates, and relative labor costs. The price is expected to fluctuate between 1.0600-1.0300 over the next 6–12 months.

In the short term, the EUR/USD pair might see increased volatility due to the strong US economic performance that may exert pressure on the single currency. However, rising interest rates, positive shifts in the troubled manufacturing sector, and diminishing concerns over China could stabilize the pair in the near term.

The main risks include potential escalations in the Middle East, which could lead to a sell-off of risky assets, and a rise in energy prices, which will strengthen the position of the US dollar.

Regarding the pound, the GBP/USD pair remains focused on the psychologically important level of 1.2000, given the prevailing bearish trend. In the short term, a downward trend seems likely. Momentum indicators have shifted to the bearish zone, suggesting the start of a new downward phase.

Other factors that may affect USD:

Future earnings forecasts are one more factor that may influence the US dollar. Some analysts suggest the possibility of a drop. One strong quarter does not guarantee similar results in the next, especially when talking about a volatile metric like GDP. This volatility is particularly evident in the post-pandemic period. After the significant third-quarter growth, the fourth quarter might see a substantial drop in GDP figures. Current consumption growth might be short-lived due to a slowdown in wage growth, the resumption of student loan payments, and tighter credit restrictions.

Furthermore, the substantial contribution from inventory accumulation in the third quarter could reverse in the fourth, impacting overall GDP.

On Friday, the dollar index lost some of its growth momentum, retracting to the middle of 106.00. Traders are waiting for new information. All eyes will be on the release of US inflation data, personal income, personal expenditure, and final consumer sentiment figures in Michigan.

The Fed's influence on USD:

On Thursday, traders actively bet that the Federal Reserve would maintain its current monetary policy this year and start reducing interest rates in mid-2024. This assumption seems surprising, considering the robust US economic growth in the third quarter. According to market indicators, especially the Federal Reserve interest rate futures, investors expect the Federal Reserve to raise its key rate by 0.25% at its December meeting, with a probability of about 24%. As a result, the rate could range from 5.5% to 5.75%. This probability was higher before recent data showed that consumer spending pushed the US GDP to grow at 4.9% annually in the last quarter. Before this release, traders estimated the likelihood of an interest rate hike at about 30%. Other earlier published reports confirmed the Federal Reserve's concerns about a potential economic slowdown, possibly leading to the decision to raise rates. Core inflation dropped to 2.4% compared to the previous 3.7%. Additionally, the number of people seeking unemployment benefits hit its highest since May of this year.

Technical analysis of USD

Overall, the dollar index is holding steady. It has not only recovered its position but also shows a tendency for further growth. The key factor influencing this rise is the yield of 10-year US government bonds, which has once again crossed the 5% threshold.

On Thursday, the dollar reached new multi-week highs around 106.90. If it breaks above the upper limit of the current consolidation range, the next potential target for the index could be the psychological level at 107.00.

The bulls also have their targets set on this year's high of 107.34, which was recorded on October 3.

At the moment, traders should pay attention to the level of 105.12. This level holds historical significance, serving as strong support and keeping it above 105.00. A breakout of this level could lead to a significant downward correction, and the index may drop to the level of 103.74.